U.K Budget Week

Senior leaders… can we be honest?

You’re carrying the weight of a six figure job…

and getting taxed like it’s a punishment!

Meanwhile, Fractional CFOs, CMOs, CTOs, CIOs and strategic operators are quietly taking home more net income than you and working fewer hours!

Simply because the UK tax code treats business owners far better than employees

With Budget Week ahead, here are 7 tax advantages Ltd Company directors use that salaried leaders simply can’t

Quick disclaimer: don’t take tax advice from strangers

Speak to a proper accountant first, Oh wait I am one…!

1️⃣ The SIPP Supercharge Employees pay pensions from net salary

Fractional leaders contribute from gross

Your Ltd can put up to £60k/year into your pension

No Income Tax. No NI. Corporation Tax relief

It’s the most overlooked wealth lever in the UK

2️⃣ The EV Advantage Want a £60k electric Porsche/Audi?

Employee → taxed income Fractional → company lease + 3% Benefit in Kind (2025/26)

That’s about £50–£60/month in personal tax

Corporate finance > personal finance

3️⃣ The Salary + Dividend Split On PAYE you hit 40%–45% quickly

As a director you structure your pay:

– Small salary (often tax-free up to £12,570) – Rest as dividends (8.75% / 33.75% / 39.35%) – No NICs on dividends

Same work Dramatically different outcome

4️⃣ The Tech Investment Write-Off Employees buy their own equipment

Fractionals deduct it

New MacBook, monitor, desk?

100% deductible with the Annual Investment Allowance

Tools paid for by the business, not your personal wallet

5️⃣ The Home Office Boost If you’re working from home (and you will be)

Your company can pay you £312/year tax-free for heat/light Small but smart Clean and HMRC-approved

6️⃣ The “Trivial Benefits” Pot Directors of small companies can receive £300/year tax-free perks

Max £50 per item No cash Vouchers, nice meals, thoughtful treats Totally legit Totally tax-free

7️⃣ The Retained Profit Advantage Employees are taxed the year they earn

Directors choose when they’re taxed Have a strong year? Leave funds in the company and take dividends when your rate is lower

Tax timing = strategic advantage

The Fractional Mindset Shift

Employees ask:

“How do I keep more of my salary?”

Fractional leaders ask:

“How do I design a business model that compounds wealth?”

If you’re a CMO, CTO, CIO or transformation specialist considering a move this year…

The tax benefits alone make Fractional work a smarter economic strategy than staying employed

Budget Week and Rachel from Accounts is in coming

This might be the moment

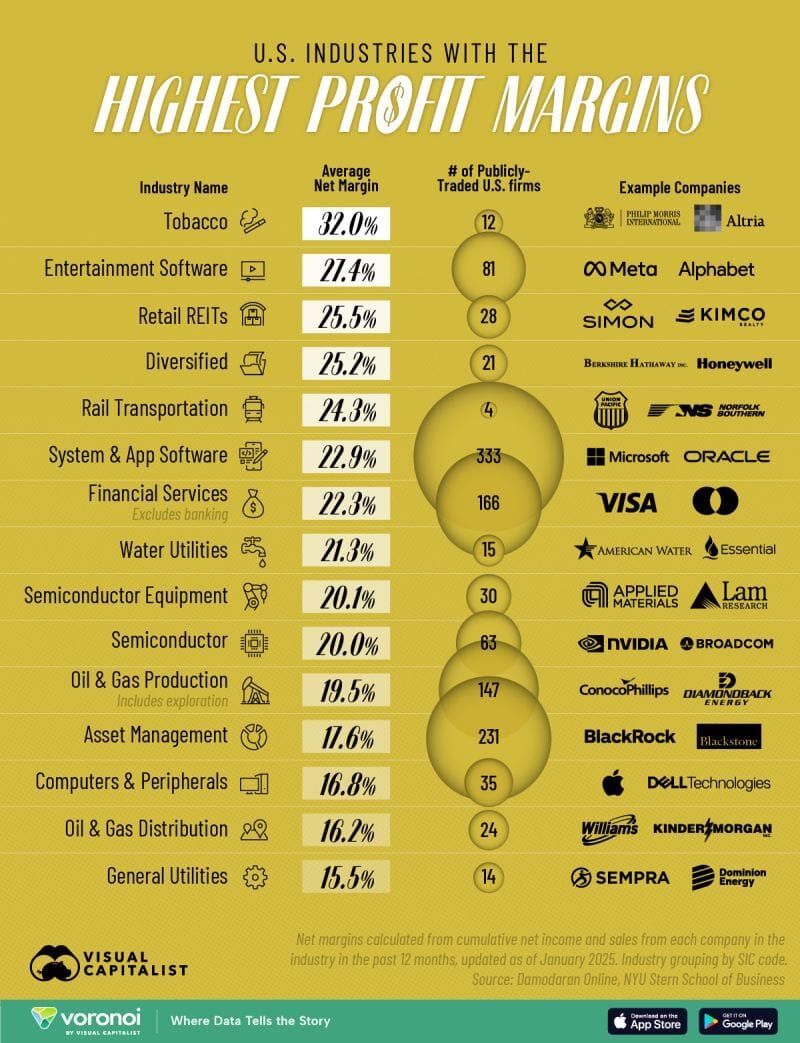

Profit Margins

In the last 12 months, one of my clients made a bold decision

They let go of 50% of their customer base!

It wasn’t because those clients were too “high maintenance” or difficult to work with

Quite the opposite….

Many had been with the business for years, and relationships were strong

So why take such a drastic step?

Simple: Margins

Over time, these clients no longer contributed to the profitability of the business

Pricing had stagnated, margins had eroded, and despite our best efforts to support them, it became clear they weren’t adding the value the business needed to thrive

It wasn’t an easy call, but it was the right one

With a firm but fair approach, we chose not to renew contracts

To our surprise, the clients understood

They'll be fine, and so will we

Actually, we'll be better!

Since then, every new client we've brought on has met or exceeded our target gross margin

Each one contributes positively to the business

The result?

We’re leaner but more profitable

The team is focused on high-value clients who appreciate the service and pay what it’s worth

By Q2 2025, I anticipate our client numbers will be back to previous levels, but this time, the bottom line will look significantly healthier

A 50% gross margin target is now non-negotiable, and we’re well on track to hit it

Here’s the real lesson:

It’s not about the number of clients

It’s about the value they bring!

Carrying customers who drain resources without delivering margins isn’t sustainable, no matter how “loyal” or “nice” they are

Tough decisions like these pave the way for sustainable, profitable growth

The MD is thrilled, the board (I’m on it!) is delighted, and most importantly, the business is positioned for a stronger, more profitable future

Not all clients are equal

If you’ve been feeling stuck in the cycle of serving low-margin customers, it might be time to make some bold moves of your own

What would happen if you focused only on the clients who truly drive your business forward?

Tesla Bull to Bear

I was a Tesla bull….

Now I'm not…

In fact I'm short!

Tesla’s Used Car Crisis: It’s Not Just Politics...

It’s a Product Strategy Problem

Used Tesla prices are falling

Fast!

Faster than almost any other EV brand in the US and UK

And while headlines love to blame Elon’s politics, the real story is more mechanical than ideological:

🛻 A glut of off-lease vehicles hit the market all at once 🔻 Tesla slashed prices on new models last year 💥 Combined, that tanked resale value and consumer confidence

When your brand is built on tech, disruption, and status…

…and suddenly your $55k Model 3 is worth $25k two years later?

And you can't find a buyer...

That’s not just depreciation…

That’s disillusionment

Tesla didn’t just create a car

It created a belief system...

I bought into it between 2015 and 2022

Then I saw through it…!

But now that resale values are crashing, even loyal fans are asking:

Is the Tesla badge still worth the premium?

This is a case study in product lifecycle missalignment

You can’t scale like a tech company and ignore what makes a car purchase different: long-term value

EV makers, take note: Brand loyalty isn't bulletproof

Resale economics are part of the customer experience

Have you owned or passed on a used Tesla recently?

What did you notice? Would love to hear from both sides of the market

Pic Credit James Eagle

Long Term versus Short Term

Deals to convert in November on the agenda

And I found myself thinking…

Is that really the right focus?

We talk a lot about vision, ambition, long-term goals

But sometimes, short-term focus is what unlocks the long-term possibilities

But it’s easy to get that balance wrong

I’ve seen businesses pour energy into 5-year plans and 10-year visions

Then lose momentum by month five

Here’s what experience keeps reminding me

Longer-term goals give direction

Short-term goals create movement

→ Win today’s call → Convert this month → Invoice this quarter

That’s where the real leverage lives

Because when the focus narrows to what’s right in front of you:

Momentum builds Patterns emerge faster Proof points start to compound

And that’s when unexpected opportunities appear

A client referral you hadn’t seen coming

A partnership that shifts your model

A new revenue stream that builds from zero faster than expected

None of that sits neatly in a 5-year plan

But all of it comes from short-term execution

I’ve seen it happen often

-A founder landing a big client this week

-An advisor delivering standout work and getting offered a retainer they never pitched for

-A leadership team smashing this quarter’s goals and attracting fresh investment

Long-term planning without short-term discipline is just wishful thinking

But short-term discipline guided by long-term direction?

That’s how you build something that surprises even you

So, what does “winning today” look like for you right now?

Because focus there and the rest usually follows

Growth Tax

Just an FYI

Brutal but true….!

You're not a CIO if you’re fixing the printer You're not a CFO if you do the bookkeeping You're not a CTO if you’re resetting passwords You're not a CRO if you’re chasing late invoices You're not a COO if you’re still scheduling the shifts You're not a CMO if you’re designing the social posts You're not a CHRO if you’re processing holiday forms

You're not a Finance Director if you’re coding invoices You're not a Marketing Director if you’re running the email blasts You're not a Head of Sales if you’re writing every proposal yourself You're not a Head of Operations if you’re packing orders at midnight

You're not a CEO if you’re doing everyone else’s job

This is the hidden tax on growth

If you want leadership impact

Stop doing the tasks that keep you small

Marketing Shambles

Marketing is a strategic shambles drowning in pointless metrics!

Harsh and somewhat sad, but in 2025, true…

Marketing is caught between vanity metrics and soul-crushing busywork, completely losing sight of the strategic perspective that once made it indispensable

IMO we’re mistaking motion for progress

CFOs, CEOs, and boards aren’t cutting budgets for fun, they’re reacting to chaos

They see teams obsessed with likes and impressions instead of dollar-value contribution

The result?

The traditional marketing agencies and departments, as we knew them, are dying

Quickly!

It’s being replaced by roles that own real 'P&L impact'

It’s perhaps time to reclaim the strategy

The future belongs to marketers who are business strategists first, creatives second

Here’s how I think you get there:

-Anchor to Business Outcomes:

Stop counting clicks. Start reporting on revenue, margin, and customer lifetime value. If it doesn’t tie to the P&L, question it

-Speak the Language of Leadership:

CAC, payback periods, ARR, NPV, these aren’t just finance jargon, they’re the tools that make marketing indispensable

-Master the Hybrid Skill Stack:

Strategic thinking plus technical depth pays - analytics, behavioural economics, AI automation, combine them to transform insights into impact

-Build Personal Brand Authority:

Companies hire people, not titles! Demonstrate measurable results consistently, and your authority becomes your job security, if you’re not digital, you don't count..!

There's a reason today you can get Marketing leaders for a few £100's per day!

Let's stop the shambles

Stop Hiding: Brand awareness without accountability is no longer acceptable

Stop Denying Change: Titles don’t guarantee security, real impact does

Stop Busywork: If it doesn’t serve a measurable strategic objective, cut it out

The future is here: hybrid, fractional, revenue-owning marketing roles focused on measurable impact

The question is simple

Are you ready to lead the strategic rebuild?

That’s it for this week.

Stay tuned for more of Rob’s best posts and insights