In Good Company…

I was watching a podcast last night

Nicolai Tangen interviewing Mike Bloomberg

Founder of Bloomberg

Former Mayor of New York for 12 years

And honestly… the guy is remarkable

He doesn’t need to work

At all

Yet he’s still in the office at 7:15am most days

He’s 84

Fit as a fiddle

Plays golf every week

-Sharp

-Curious

-Engaged

So why does he keep showing up?

-Not ego

-Not money

-Not legacy-chasing

Because he loves the work

Because he cares

-About people

-About the environment

-About his employees

-About building things that matter

It made me think:

Maybe the goal isn’t “retirement”

Maybe it’s finding work you never want to retire from

Energy doesn’t come from age

It comes from purpose

And the people who last the longest

Aren’t the ones chasing success…

They’re the ones who genuinely enjoy the game

Building Real Relationships

Over the last few years, a friend and I have been quietly hosting small, privately curated dinners

Usually 10–12 people, once a quarter, at a country-house hotel where the atmosphere does half the work for you

No photos

No branding

No speeches

No LinkedIn posts the morning after

Just 'interesting people doing interesting things'…

Sitting together for an evening that feels warm, conversational, and (if we’ve done it right) hard to leave

People often assume these gatherings require big theatrics or complex formats

They don’t

In fact, the more you remove, the better they get...

A few principles we’ve learned:

• Don’t have everyone stand up and introduce themselves

• Send a guest list ahead of time so the room already feels familiar

• Enable seating which can lead to easy conversations & to build trust through conversation

• Look to keep it under 12, any more and the intimacy evaporates

• And depending on the vibe, follow up with a simple message so people can reconnect thoughtfully

And I’m just a guy in the room, no agenda, no pitch, no “curator” title

But when you gather genuinely interesting, kind, curious people… the alchemy happens on its own

Leaders don’t need more noise

What they crave quietly are spaces where conversations feel effortless, intimate, and genuinely valuable

We’ll keep hosting these dinners during 2026

And every time people ask, “When’s the next one?” it reminds me:

In a world full of big events, small is still the most powerful format of all!

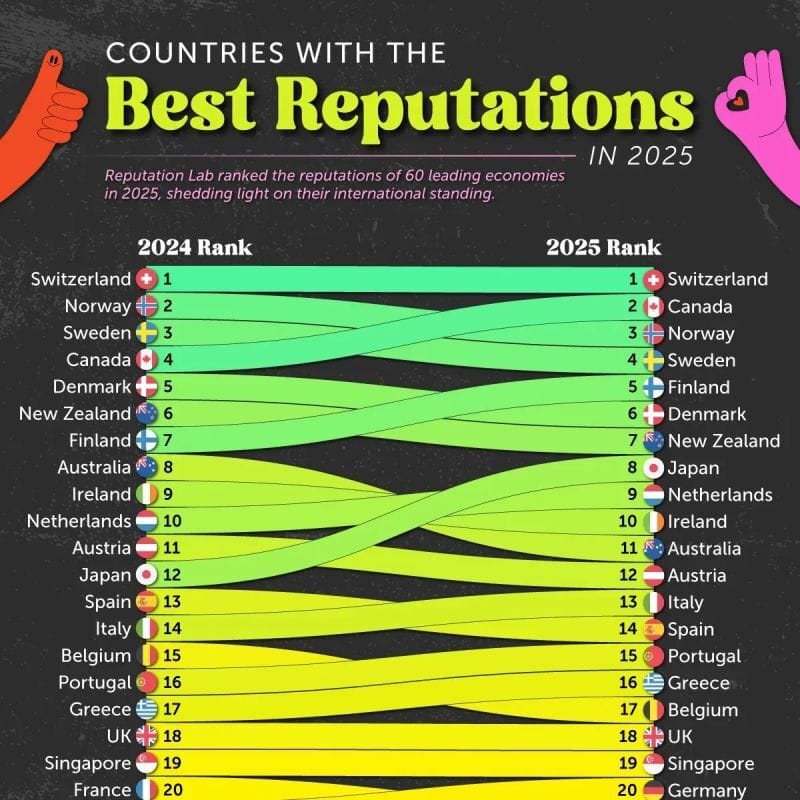

Looking Beyond the Surface

Most people will look at this chart and miss the point

Switzerland at #1 isn't news

But three patterns here tell you everything about how reputation actually works in 2025:

1. Stability is the new strength

The UK holds at #18. Flat feels unremarkable until you realize what it means to hold steady through geopolitical chaos, economic uncertainty, and constant political noise. In volatile times, not falling is its own achievement

2. The Nordics aren't lucky

Switzerland, Norway, Sweden, Finland, Denmark: consistently top-ranked, different economies, same result

They're not running reputation campaigns, they're building institutions, maintaining trust, governing with consistency. Reputation sure compounds when you stop chasing it

3. Japan rises. The USA disappears

Japan climbing into the top 10 is the chart's biggest signal: quiet diplomacy, predictable policy, operational credibility. Meanwhile, the US drops out of the top 20 entirely. That doesn't happen overnight. It's years of volatility eroding trust & trump!

The real lesson:

Reputation moves slowly until it doesn't

And when it shifts, it reflects accumulated behaviour, not recent messaging

The question this should prompt: Are you optimizing for short-term attention or long-term belief?

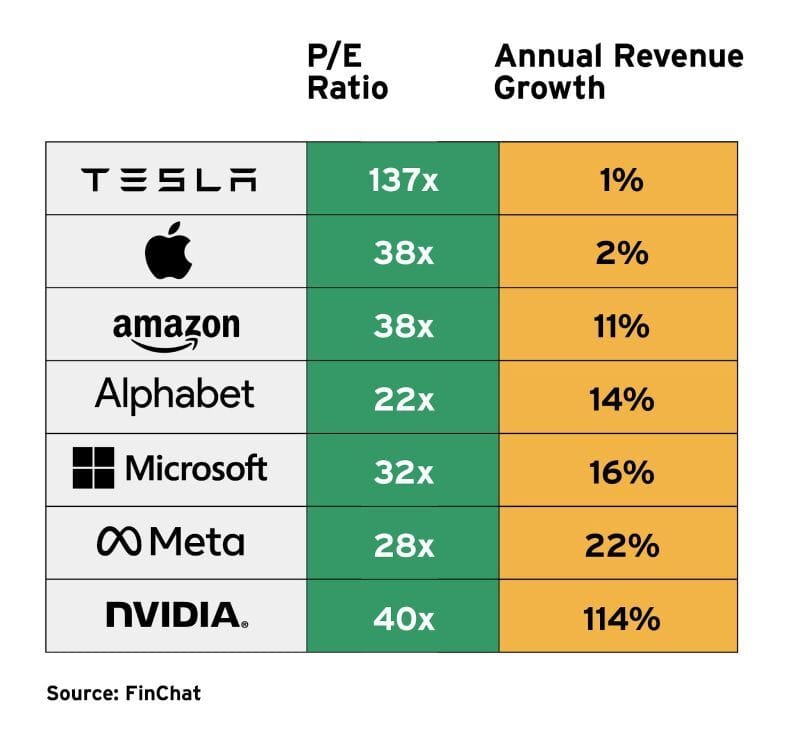

Apple, Still Innovating?

Growth is a game…

Is Apple still playing?

I don't think it is!

Apple has long been the gold standard of innovation, but its growth story is fading

And fast!

Despite a 38x P/E ratio - the same as Amazon

But Apple’s annual revenue growth is just 2%, while Amazon is growing nearly 6x faster

Microsoft, Alphabet Inc., and Meta are also outpacing it, while NVIDIA is in a league of its own with 114% growth

Where’s the Innovation?

Apple once disrupted industries with the iPhone, iPad, and Mac

But today?

- iPhone sales have plateaued, yet it still makes up 51% of revenue, but growth is stagnant

- Apple Intelligence flopped just 42% of users tried it, and 73% found it useless

- The Vision Pro is niche, not a mass-market success

- Project Titan (Apple’s car) was scrapped, missing a chance to rival Tesla

btw Can you imagine how well they'd be placed with Tesla's slide...!

Apple is spending more on R&D than ever, yet delivering only incremental updates

A shrinking growth premium

The market rewards innovation, not stagnation!

Companies like NVIDIA, Microsoft, and Amazon are expanding into high-growth areas like AI and cloud computing...

IMO, Apple, on the other hand, trades at a growth valuation despite no longer being a true growth company

For business leaders, the big question is:

Is Apple still worth the premium?

I sold ALL my holdings….I've been in the stock since 2008…!

As innovation shifts elsewhere, is it time to rethink where we invest, partner, and focus?

Where do you see the next wave of real growth coming from?

Pic Credit : Prof G Markets

U.K Pricing Strategy

Your prices are still way TOO LOW…

Yes…still…!

And that’s a problem

Yes, really

I've been banging on about this for a while and yet almost every client I meet, has the same opportunity

Here’s the thing: prices for almost everything in the UK remain far too low

We all compare prices, I do it too

But when you stack UK pricing against the US? The gap is staggering

We’re not talking “a bit less”

We’re talking orders of magnitude lower

And then we wonder…

Why don’t UK businesses enjoy the same margins and valuations as their US counterparts?

Simple

Because our pricing doesn’t reflect the true value of what we deliver

And this runs across the board:

• Food

• Energy

• Water

• Tradespeople

• Internet access

• Mobile phone contracts

• Professional services (legal fees, conveyancing, accounting, you name it)

A few examples from my own life:

📱 Mobile Phones: In the UK, I pay £36/month for three lines. In the US? $278 for the same. No wonder Verizon’s worth $190+ billion, up $20bn in 6 months…!

🌐 Internet Access: UK broadband - £22/month, In the US - $80/month for a comparable service!

🏡 Real Estate Fees: Selling a house here? Around 1% commission, In the US?

They laughed when I tried to negotiate and then charged me 6%!

See the pattern?

Here’s the uncomfortable truth:

If UK businesses want higher margins, stronger profitability, and valuations that actually mean something…

We have to stop under-pricing ourselves

This isn’t greed

It’s sustainability

It’s about reinvesting in our businesses

It’s about rewarding talent properly

It’s about building companies that can compete globally, not just scrape by locally

Yes, prices will rise

Yes, we’ll all have to get used to it

But if we want growth, innovation, and long-term success?

This is the reality

That’s it for this week.

Stay tuned for more of Rob’s best posts and insights